5 reasons why you should invest ethically

/Consumer demand for ethical investing is on the rise, now almost £13 billion of UK investors’ money now under the management of ethical funds (Investment Association). We’ve put together a few reasons which why this may be happening and why we think you may want to consider investing ethically.

1. You can decide what your money is financing. If you currently invest in a pension or an ISA there is a very strong chance that your money could be financing, among other things, weapon production, animal exploitation or environmental damage. If the impact that your money may have on such issues matters to you then responsible investing is something you should consider.

2. You can make a difference. Nowadays investors have a growing choice of funds and can personalize their portfolios to make a positive difference. Impact investing is investing made with the intention to generate positive, measurable and environmental impact alongside a financial return. Here is an example below (ImpactBase)

A European private equity fund invests between several million in companies that provide clean electricity to rural communities in developing countries with limited access to energy. The fund made an investment in a company that provides solar energy for lighting and refrigeration in rural Indian households, schools, and hospitals that have limited access to the main electricity grid. Enabled by this investment, the company has installed more than 40,000 systems and currently offsets 25,000 tons of carbon dioxide emissions.

Some positive criteria which a fund may choose to invest in are: minimising animal testing, environmental management and human rights support.

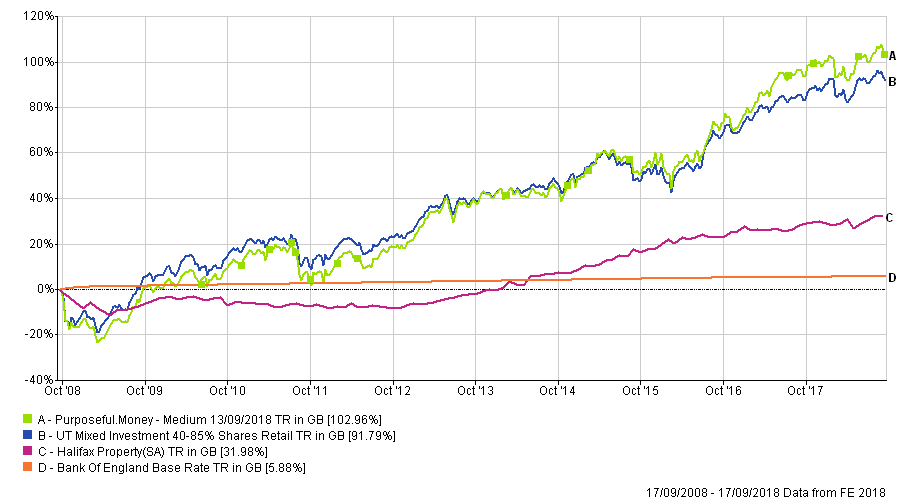

3. You don’t have to sacrifice financial returns. For a long time, ethical investing had negative connotations attached to it; more volatility, lower returns, higher costs. Fortunately, a remarkable transformation has taken place as many ethical funds currently on the market consistently outperform their more conventional and established their peers.

In a journal by Friede (Deutsche Asset &Wealth Management) and Busch (University of Hamburg), over 2000 empirical studies on the relationship between ESG factors and corporate financial performance from the past 40 years were aggregate. The journal concluded that 90% of them have found that ESG factors have a positive or neutral impact on financial returns.

4. It makes sense. Investing ethically provides solutions for environmental concerns in the long term such as global warming and pollution, and investments supporting these tend to hold firm in times of volatility.

5. Psychic returns (non-wealth motivations). Making a positive difference to the world we live in through your investment decisions can give a feel good factor, just like when you would donate to charity or volunteer. All whilst insuring a hopefully brighter future for now and the generations to come.