#schoolstrike4climate #fridaysforfuture

/When we hear about strikes in the UK, the first thing that comes to mind is the commonly occurring industrial action strikes but now there is another kind of strike taking Westminster, Parliament Square and the streets of many other British towns and cities – climate strikes.

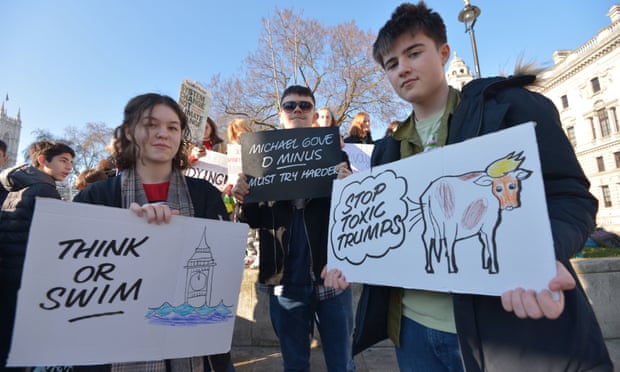

Students join the protest in Westminister. (Image Source: Nick Ansell/PA)

To understand all this better, let us first introduce Greta Thunberg. In her twitter bio she describes herself as a “16-year-old climate activist with Asperger”. When she was younger Greta said to have been shown documentaries at school entailing the disastrous effects of climate change on the environment as well as the surrounding wildlife. These images stuck with Greta and since then she has convinced her parents to become vegetarian, then vegan, as well as urged her mother (a well-known Opera singer in Sweden whose career depends on travelling) to not fly anymore.

More recently, 25 weeks ago to be exact, Greta decided to skip school to protest in front of Swedish Parliament for the fact that adults have failed to protect the future generations from their actions resulting in climate change.

At the recent COP24 summit Greta accuses adults of “stealing their (children’s) future in front of their very eyes”, she also says we need to keep fossil fuels in the ground to not make any matters worse. (Full video of Thunberg’s speech at the COP24 can be found below)

The COP24 or the 2018 United Nations Climate Change Conference took place between the 2nd and 15th December 2018 in Poland. The conference was primarily used to agree on rules to implement from the Paris Agreement that will come into force in 2020.

Since the climate change agreement summit Greta has been motivating children and students around the world to leave school every Friday, like her, to urge adults to take climate action including transitions to greener energy sources. These strikes were inspired by the school walk outs that took place after the deadly school shooting in Florida on February 14th last year.

Continuing her campaign at the World Economic Forum, Greta Thunberg arrived after a 32-hour train journey, unlike the delegates who reached the forum in Davos, Switzerland by up to 1,500 individual private jet flights.

Greta Thungberg in Davos. (Image Source: Twitter)

Further taking her efforts to social media where she is able to reach more of younger crowd Greta uses hashtags #climatestrike and #fridaysforfuture, inspiring children to “demand the preservation of their futures”.

The word has spread all over the globe, school children from Switzerland have travelled for 26 hours by train to visit her to ask for her assistance with petitions requesting tougher carbon emission laws in Switzerland. Individual Twitter accounts have been set up for regional youth climate strike action groups spanning from New Jersey (USA), Belgium to India and France, all aiming to have a global school walk out on March 15th involving students from more than 40 countries.

More than 20,000 students held strikes in at least 270 cities (as at December 2018), all wanting the government “to declare a climate emergency”.

These school strikes have already caused much controversy, Theresa May has slammed young people staging mass walk-outs stating ‘disruption to planned time was damaging to pupils and increased teacher’s workloads’. Other people have taken to Twitter admiring the younger generation’s stance on implementing change, saying that demonstrating in such a protest would not hinder a job application but enhance it.

Students striking in Australia. (Image Source: Mike Bowers/The Guardian)

What are your thoughts on children stepping up for tougher climate targets and reforms?

Greta Thungberg full speech at UN Climate Change COP24 Conference. (Source: Youtube)